We’ve started to ask ourselves when the next recession will start. Our observation is that the M&A multiples are at – or a bit past – theirs prime for this business cycle. Also, banks seem to be having more credit problems. There is a rumbling among them that suggests they think it’s time to curtail the hell-for-leather business development mania that has been running its course the last several years.

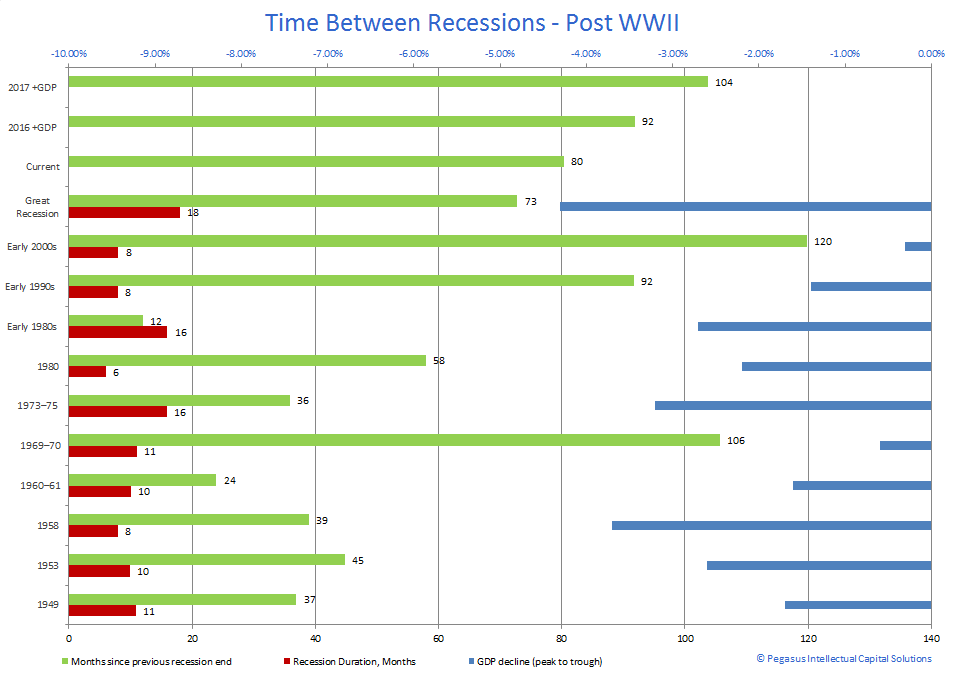

It’s clear that our current economic expansion is past its prime and is now eligible to join AARP. At 80 months old, it exceeds the post WWII average of 60 months, as measured from the end of the previous recession.

Our sense is that 2016 will be okay, and so any recession must be in 2017 or later. In looking around the world, China is suffering a minor – if not larger – meltdown, putting downward pressure on commodity prices. As a result, all commodity related companies are marking-to-market their inventory, or kicking the can down the road by flowing above market cost-of-goods sold through their income statements thus deflating earnings. On the bright side, the consumer is the direct beneficiary. John and Jane Doe will put less dollars’ worth of gas in their car this summer and have more to spend on everything from eating out to taking a summer vacation. That’s why we think 2016 will be okay.

But we’ve also looked at CAPEX in O&G E&P; it’s down a third, and will lead to higher gas prices within 24 months, maybe less. Fracking wells play out in 18 months or so, so lower supply is looming. So, we looked at the length between the post WWII recessions, and extrapolated out our current expansion through this time in 2017, and then 2018.

Here’s the conclusion we drew based on some Kentucky Windage and simple observation: we look like we might have another 12 and 24 months of modest growth.

If we avoid a downturn for another 24 months, our expansion will be 104 months old. This will lag only 1st place winner of 120 months, and be nearly tied for 2nd place contestant at 106 months. This will still place it in the top 25 percentile of expansions.

We noted that the expansion that preceded the Great Recession was 73 months long (5th place), and we are at 80 now. We didn’t find that much of a comfort. The second longest post-war expansion was 106 months but it was followed by the stagflationary 1973-75 recession. This was a period of economic stagnation and high inflation in much of the Western world during the 1970s, which put an end to the general post-World War II economic boom. Again, we found little comfort in this.

While it’s possible that the Fed has found an anecdote to gravity, we have started to model a recession in 2018. In fact, we’ve almost started to hope for one. If we somehow eclipse the 120 month leader, we’ve begun to wonder what price we will pay.

© Pegasus Intellectual Capital Solutions