Going to market is like going to sea: do it while its calm

At some point, most business owners will ask themselves “When should I sell my company?”. This is important. Timing matters.

One of the articles I read recently was entitled “Banks Ride Business World’s M&A Wave”. That my caught my eye in addition to another, seemingly unrelated, article: “Fear Index Off Lows as Volatility Spikes”. My immediate thought was that mergers and acquisitions lending will fall in the near future.

It’s no secret that leveraged buyouts are big business with banks. Many of the larger banks have specialized groups, variously named, that handle the private equity groups that are behind much of the leveraged buyout lending. And there are of course the strategic buyers – every day companies – that also play in this market too. Both are plenty smart. Certainly smart enough to know when it’s time take risk and when it’s time to avoid it.

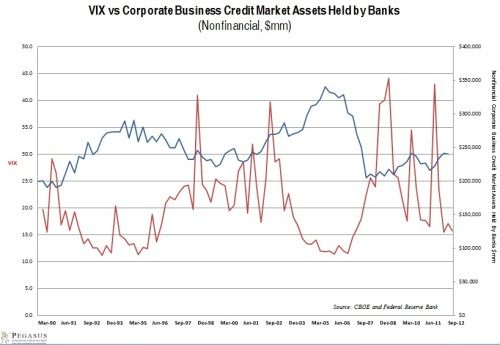

Our belief is that M&A lending has picked up because certainty has improved. What everyone had been looking has been some semblance of stability. The VIX option on the CBOE (domiciled here in our hometown, Chicago), is one of our favorite things to watch. Recently we looked for research regarding the relationship between stock market volatility and commercial lending activity. We didn’t find anything useful.

So we downloaded historical data on the VIX – the measure of statistical volatility of the S&P 500 – and Federal Reserve data on commercial lending activity to businesses (non-financial). Our work seems to indicate fairly clearly that a lack of volatility drives business lending activity. That should not be a surprise to anyone. The reason, we think, is quite simple: businesses hate uncertainty. That includes private equity groups, regular companies and Chief Credit Officers of the banks.

When the world looks uncertain, people don’t take risk. Buying a company is risky. Sales can fall by dramatic amounts (as they did in 2009) and you can lose your entire investment. The take-away for a business owner is that they should sell their company during a period of calm in the market. This will be an emotionally difficult decision for many business owners to sell, because who wants to get out when things are going well?

I know of too many owners who rode through the good times just to be forced to sell during bad times. Falling sales and faster falling EBITDA, covenant defaults, and forbearance agreements all cause serious damage to the market value of a company. Selling under duress is the worst of situations. About all you could add to that is failing health of the owner, and I have seen that as well. We sometimes see mourning families with all their net worth locked up in a leaderless company. Avoiding this is part of exit planning.

When you can, sit down with a piece of paper and write out when you intend to sell your company. What are the markers? I would suggest that you are still in good health, maybe 5-7 years from your intended retirement, your business is stable or positive, and banks are lending. You’ve achieved what you want from a personal gratification standpoint. And I would add at the end, the stock markets have low volatility as measured by the VIX.

You can see a current chart of the VIX here

If you’d like to learn more about mergers and acquisitions or exit planning, contact us at info@pegasusics.com.

(1) This article written in February 2013. In 2016, Harvard Law School published an article “The Real Effects of Uncertainty on Merger Activity” which confirmed our thesis about using the VIX as an indicator of market stability in predicting M&A activity