The first digital camera, invented in 1975 by Kodak

The year 2012 has seen two famous companies collide with the Knowledge Era. Kodak was dropped from the Dow Jones average in 2004 and filed for bankruptcy in January 2012. In March 2012, The Encyclopedia Britannica announced it would no longer produce a print version.

But Apple, once on its knees, is the most valuable company in the world. As late as March 2003, its stock price was a meager $7.01 compared to its recent close at $542.83. In March of 2003, Kodak was trading at about $28.00, compared to its recent price of $0.21.

So why the difference in fates?

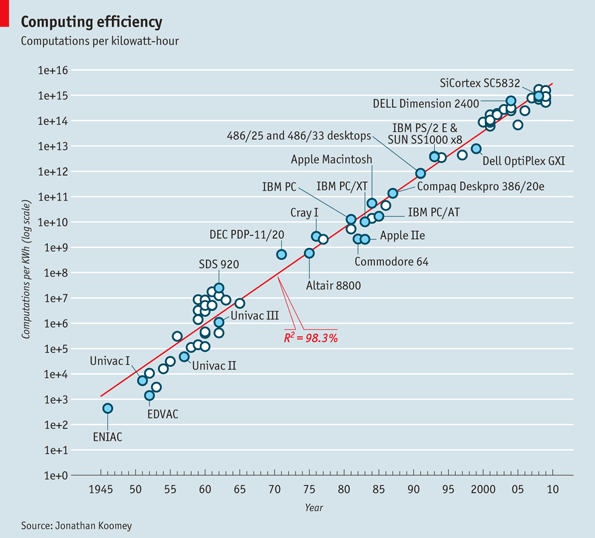

We can all blame Gordon Moore, the Intel engineer, and Moore’s Law: integrated circuit speed doubles every year (now 18 months). Some of us understood it, and some of us didn’t.

You may rightfully ask, what does this have to do with me? The answer is, if you are a business owner, an understanding how Moore’s Law will affect your business will affect the value in a mergers and acquisitions transaction and in your ability to raise capital. It will also determine your resistance to financial distress.

In 1975, Steven J. Sasson, one of Kodak’s research scientists, developed the first working model of the digital camera. It was met with doubts and questions from management. Moore’s Law was understood by Sasson, and he projected that in 20 years the technology would exist to create a digital camera with the storage and resolution that would make it a viable competitor to film.

But Kodak management couldn’t envision how consumers would use and share photos on their TV. The TV, or course, was the only viewing device for a digital photo of the era. And the TV was hampered by its own problems with resolution. High definition and 1080P were concepts yet to be created. Besides, Kodak saw themselves as inventing and selling coatings for films.

A line from Kodak’s internal report sums it up ““The camera described in this report represents a first attempt demonstrating a photographic system which may, with improvements in technology, substantially impact the way pictures will be taken in the future.” But, as they now acknowledge, they had no idea.

The playback device for the first digital camera: the TV. Its all executive management could envision.

Kodak had made two critical mistakes. Had they avoided one or the other, they might be prospering today.

– They put the digital camera and its patents back in the Warehouse of Lost Knowledge and promptly forgot it was there, just like the Arc of the Covenant being rolled back in the government warehouse in that unforgettable scene from the 1981 film “Raiders of the Lost Arc.”

– They defined themselves incorrectly: Fuji Film was in a very similar situation as Kodak. So why did they not meet the same fate? It defined itself differently. In its culture, it made chemical coatings, not film. It simply transitioned to coating other products, and used the same research engine.

And the first digital camera – and its patents – were rolled back into the warehouse of lost knowledge.

Encyclopedia Britannica had advance warning that it needed to change. Encyclopedias first came out on CD in the early 1990’s, and CD’s could be searched. But salesmen ran the company, and without their sales commissions for selling a print edition, they couldn’t see what other business model would benefit them personally. And so the company has become a shadow of its former self compared to the free and collaborative Wikipedia.

But what about Apple?

When Steve Jobs first initiated the R&D to develop the iPad, the technology didn’t exist. But Jobs foresaw that Moore’s Law would bring integrated circuit size and cost down to the place where he could make his wafer thin device technologically possible and economically affordable. By the time R&D was completed, integrated circuit size and cost had shrunk to a fraction of its former self, and a star was borne. Now the retailer Kohl’s plans to dispense with its cash registers and use only iPads due to their far greater number of applications.

Neither Kodak or Encyclopedia Britannica could see that the world was changing and would obsolete their way of delivering solutions to their customers. The customer needs still existed, of course. But the way of satisfying them are hardly recognizable. Photos and videos are taken from one’s cell phone, sent by text message to friends and family and uploaded to YouTube and Facebook. All information is at your fingertips at Wikipedia, which is one of the most visited, collaborative, and authoritative sites on the internet.

Things will get tougher in the next twenty years as the exponential improvement described by Moore’s law ultimately leads to the possibility of a technological singularity: a period where progress in technology occurs almost instantly.

A technological singularity is the theoretical emergence of greater-than-human superintelligence through technological means. Since the capabilities of such intelligence would be difficult for an unaided human mind to comprehend, the occurrence of a technological singularity is seen as an intellectual event horizon, beyond which events cannot be predicted or understood.

Computing speed will eventually collide with the rest of the corporate world.

Proponents of the singularity typically state that an “intelligence explosion”, where superintelligences design successive generations of increasingly powerful minds, might occur very quickly and might not stop until the agent’s cognitive abilities greatly surpass that of any human.

So, if Kodak had a hard time as early as 2004, and Encyclopedia Britannica started to struggle in the mid-1990’s, what exactly is going to happen to the rest of the corporate world and how do they prepare for it?

Corporations need to create off-site tech groups in Silicon Valley or in the Biotech world to protect their creative people from any corporate culture that prevents a rethinking of how things are done and why they are done a certain way. The creative, contrarian people are hard to manage by definition, and our Human Capital departments will need to make a place – a protected place – for them in the corporate environment.

Companies will need to white-board virtually constantly. When they wake up in the morning, the first thing they will need to ask is what changed overnight. They will need to create challenger teams that do nothing but come up with ways to obsolete and defeat everything the company does now, much the way Top Gun uses experts in our enemy’s methods and equipment to attempt to defeat our best pilots.

Collaboration will become more important than ever. No one person, or a single board or executive team will be able to assimilate all the information necessary to stay abreast of the changes unfolding. Corporate cultures will need to be designed to provide for the fluid exchange of information in all directions.

Whereas information has historically only traveled upwards in our Command and Control corporate cultures, those that survive will ensure that knowledge is exchanged downwards and sideways. This will run counter to the cultures of many companies, and the a Human Capital function will need to select for people that have the willingness and ability to share information freely and not control it.

In the world of finance, those companies that disclose that they are preparing for the future (without giving away their secrets) will enjoy a lower cost of capital, higher stock prices, have an easier time capital raising, enjoy higher mergers and acquisitions values and, and avoid financial distress.

As a result of all of this, the the Human Capital function in companies will become more important than ever. The selection and training of informed, collaborative people that freely share information will be central to a company’s ability to survive and prosper in an environment where progress in technology occurs almost instantly. To learn more, contact us