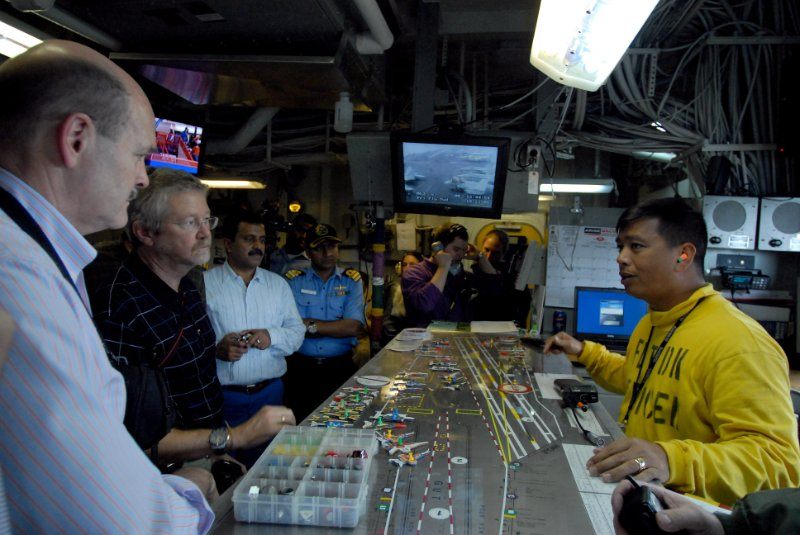

Its important to know where your assets are on the flight deck

Defining your market segment and developing your business processes are essential to creating a unique corporate culture. These are ingredients that go into your special sauce. My firm has its special sauce, and its ingredients were derived from my personal experiences. Here are my experiences with PEGs processes and cultures that keep the average from joining the awesome.

The average:

1) Believe that high quality, high growth companies can be acquired for the same price as low quality, low/no growth companies

Some firms think that quality companies can be had for 5-6x EBITDA, and some would even say 3-5x. In the 1980’s, this was true. But today, underpriced companies are statistical outliers, a bit like a four leaf clover. Acquiring outliers is not the foundation of a long term strategy. It’s hoping that Santa will drop a bag of money down your chimney.

In today’s market, PEGs that want to buy cheap are, in effect, sorting for low quality companies. You get what you pay for, mama used to say.

My advice to these firms is that if you want quality, have a plan on maintaining and improving the company, and be willing to pay for it. There is a vast difference in the growth rate of companies, and growth is one of the biggest drivers of value. Play with the Gordon Dividend Discount model for a few minutes and you’ll understand how growth affects value.

2) Think EBITDA is the same as cash

There’s a reason it’s called the Discounted Cash Flow Model and not the Discounted EBITDA Flow Model. Companies vary wildly in their required investment in working capital and PP&E. All that matters is cash flow after reinvestment in these assets. I’ve seen companies that needed to invest 30% of incremental sales back into incremental working capital and PP&E for every dollar of sales growth. I’ve also seen companies that had negative working capital of 30% of sales. These are companies that get paid up front. This is a shocking variance.

If you benchmark value off EBITDA without looking at working capital and fixed asset reinvestment rates, you simply don’t understand value creation. EBITDA is a lazy man’s reference point. Roll up your sleeves and benchmark cash flow and growth rate for the peer group and the target. And whenever you talk to someone in-house about a multiple of EBITDA, also include a reference to multiple of cash flow so that your culture is focused on what matters.

3) Focus on beta error to the exclusion of alpha error

Beta error, aka Type II error – accepting a false premise – is looked at by all PEGs. An example of beta error is acquiring a company that performs below expectation and fails to return your hurdle rate. But alpha error, aka Type I error, rejecting a true premise, it very expensive too. That would be rejecting a company that does well.

Some PEGs fly so high they never get below 10,000 feet. “Business service company under $25 million in revenues? 6x EBITDA is my maximum price.” They never bother to look at growth rate, profitability or required incremental investment. TTM EBITDA is all they seem to need.

Detail matters, so building a better sorting system is the place to start if you are to have sufficient time to figure out why a company has performed against peers as admirably as it has. So would creating a tracking system to understand how companies did that you rejected, and then figuring out why you rejected them. But that, of course, takes effort, just like looking at actual cash flow instead of TTM EBITDA.

4) Don’t do longitudinal analysis, or don’t model

I’m shocked at the number of firms that will settle for three years of financial statements and think they know what is going on. I don’t know how they model the future if they don’t know the past. It’s like looking at a photograph and thinking you’ve seen the movie. By so doing, they miss a basic lesson from statistics: the larger the sample size, n, the greater the statistical reliability.

I can only surmise that firms that settle for three years of data aren’t modeling the future. That is in effect assuming stasis. If so, they will never accurately value companies that have a future, and are sorting for laggards.

The whole purpose of financial analysis is to identify sources of variance and determine trend. Longer is better than shorter. That’s why a good sniper can fire a 30 inch barreled rifle over 1,000 yards with accuracy, while one with a 5 inch barreled pistol does well to hit anything at 25 yards. Yes, size matters.

5) Skim CIMs

I think the analysts and associates are pretty good about doing their homework. But when the deal summary gets to an MD, it seems that they are too busy or too important to do something as menial as homework. My sense is that some believe that they are experienced and so can just feel things in their gut. Oh, to have such a crystal ball…

While a feeling in the gut is tremendously important, arming oneself with the facts first goes a heck of a long way to giving your gut something to work with. Without facts, it’s a reflex, and that’s just another name for a knee jerk reaction. Some of the greatest thrashings in military history – Bay of Pigs, the first half of the Battle of the Bulge, and the Battle of the Chosin Reservoir (Changjin Lake Campaign 장진호 전투(長津湖戰鬪; 长津湖战役 )- were due to leaders’ fatally flawed perceptions which prevented them from seriously looking at evidence already in their possession.

6) Don’t have investment criteria

When I go to a PEG’s website and can’t find investment criteria, I can’t help but shake my head. I can’t tell if they are just poor marketers or they are suffering from an identity crisis. If I can’t find investment criteria, I move on because I’ve already learned all I need to know.

What’s a good description of investment criteria? Here is one of the best I’ve ever seen: http://www.thehalifaxgroup.com/wp-content/uploads/2014/01/Website-Target-Industry-Brochure.pdf

It nearly made me cry with joy when I read it. Cheers to The Halifax Group. I don’t know anyone at their firm, but their attention to detail compels me to.

7) Don’t list contacts or email addresses

I am at a total loss to understand why a PEG wouldn’t list a person or their email address to write to. It tells me that they aren’t running a business. They’re engaging in a hobby. As to email addresses, info@blahblahblah.com isn’t a contact email, it’s a spam trap. If you aren’t getting any deal flow, consider listing a BD point person with a real email address.

8) Have overly restrictive spam filters

Some PEG’s, particularly their MDs and partners, are annoyed by the volume of email they get. Who isn’t? One lesson I’ve learned is that you haven’t arrived until you see your name in graffiti on a bathroom wall. Getting deluged with email is a sign that you’ve arrived. This is just part of playing in the big leagues.

But having spam filters set to TSA scanner levels is not the solution to “too many emails”. The solution is to have a good admin. See #2: “alpha error versus beta error”. The best BD guy I know has 3 admins that do nothing but sort through his emails. Yes, three. What you can’t imagine is how much great business he does. Never does a grain of wheat get sorted out with the chaff, and this is definitely a game of finding the grain of wheat.

9) Have poor transaction tracking

I am really shocked at how people either don’t check their email regularly, or don’t respond to email on a timely basis. In my first job in finance, we had to pick up the phone in three rings. We also had to get someone to cover the phones for us if we needed to use the men’s room so that the phones weren’t left unattended. I think this is something that should be brought back: service.

A close relative to not checking email is an overly relaxed attitude of timeliness. Back in the early 90’s we used Ouija Boards – miniature aircraft carrier flight decks – to visually see where our projects where in process. With the advent of digital tools we have lost visual stimuli. Everything disappears into zeros and ones in cyberspace. Perhaps it’s time to bring back visual cues so we know when we are about to inadvertently push a $65mm F/A-18 off the starboard side of the flight deck. That said, even the Navy converted to digital Ouija Boards last year. Regardless of whether you use a physical or virtual Ouija Board, you need to immediately see where your assets are when you walk into your operations room.

10) Have an NDA obsession and fish for trade secrets

When a PEG tells me that they never sign an NDA with an effectiveness over 12 months, I can’t help but laugh. The one condition where I would agree to give a PEG a short lived NDA is if I get to pry into their family affairs and am only bound to keep them secret for a year. What goes around comes around, mama used to say.

I don’t understand why there is so much chest thumping that goes on just so they can tell their buddies that their NDA’s only have a life of X years. It begs the question: if this is what negotiating an NDA is like, what would negotiating a sale agreement be like? Yee gads.

Here’s what one client of mine said to a prospective acquiror who wanted to learn about the inner workings of his company: “If you want the privilege of stepping into my world, then mind your manners.”

While I respect that a firm might have a concern with a nuisance law suit, you are about to receive highly privileged information that commonly falls into the trade secret category. If you want to fish for our client’s secret sauce, you have just blown your cover. I mark my CRM immediately with DO NOT CALL and move on.

11) Don’t monitor or mentor Millennial’s manners.

Okay, I lied. I’ve noticed 11 differences. This one seems to be mostly a Millennial generation mentoring problem.

When someone says “thank you”, the correct response is “you’re welcome”, not “no problem”. If you don’t want to train Millennials to say thank you, at least train them to use their best Arnold Schwarzenegger accent to say “no problemo” in an allusion to Exterminator II. That way I’ll know they are making a joke and give them points for wittiness.

It seems the older I get, the more manners count. As long as baby boomers are business owners and clients – the ones with the money – Millennials will have to operate in their world. There are two books to offer to your millennials. The first is “How to be a Gentleman”. I wish the title was gender neutral but the book is relevant anyway. The second is “Don’t: A Manual of Mistakes and Improprieties more or less prevalent in Conduct and Speech”, first published in 1880 and priced at one shilling. I read the second edition. Yes, it’s well seasoned, but good manners are always in style, just like please, thank